Running Up That Hill (A Deal With The Devil?)

Why the Government renewable energy contracts lock in higher energy prices and are the scandal no one seems to be talking about, BUT should be!

www.marginalcostofeverything.co.uk is now live and is the main portal for MCOE Consultancy services. If you or your firm are looking for advice on how to optimise your energy mix, ensure energy security for your firm, or looking for policy advice at a higher level. Please reach out.

In 1985, the great Kate Bush sang of making a deal with God in Running Up That Hill. I want to leave that image in your mind as we take a dive into the Government contracts with renewable energy generators, otherwise known as Contracts For Difference (CFDs). I will be returning to Solar’s Odyssey shortly , however I’m conscious that to understand some of the main themes it is crucial to understand how renewable energy provider contracts are structured.

Now, there may be collective groans in what could on the surface appear to be a very dry topic, but believe me this is one of the most crucial aspects of the new Green Energy Landscape and it is vital that people know the deal that has been signed (with the devil). My aim is to try and present with as little jargon as possible so that everyone can understand the lunacy of the current structure of what will define our electricity prices today and into the future.

How does the Contract For difference scheme work?

Put simply it is a long term contract (15 years ordinarily) between the energy generator and the Low Carbon Contracts Company (The government), to supply energy at a fixed price per unit produced (£ per MWH). It is made up of 3 main components:

Strike Price-The price the government agrees to pay the generator for each unit of electricity

Market Reference Price- The market price for electricity. This is set in hourly increments for Intermittent providers like Wind and Solar, based on the day ahead auctions (where the market will buy and sell electricity for tomorrow). I’m going to focus on Intermittents for now rather than baseload providers like Nuclear and Biomass as I will cover these separately.

Difference Payment- The difference between 1) and 2). If the market price is below the strike, the government makes the generator whole for the loss they would otherwise have for each unit of energy they produce. If the price is higher, the generator makes the government whole.1

So far so good hopefully. The key thing is the strike price is clearly crucial in determining if the government and by proxy us are getting value for money.

How is the Strike Price calculated?

The contracts are awarded by auction in Allocation Rounds (ARs) with sealed bids by generators for the minimum they would be prepared to produce for. The Government1 then for a budget of X, multiplies the amount they commit to produce by the strike price until the budget X is filled (total energy in Mwh produced x lowest accepted strike price). Hope you’re still with me.

So far so good, competitive markets should drag down the price to a level that is acceptable. Right move on nothing to see here. Except that is not the end of the story.

The Strike Price is linked to inflation!!??

Below is taken direct from official documentation on Strike Price Adjustments. If you like equations then you’ll like the below but the key point is that the Strike Price is adjusted with inflation (CPI) over the lifetime of the contract:

“Strike prices are currently linked to the Consumer Price Index (“CPI”). Consultation respondents raised concerns about potential exposure during the time between bidding and reaching the final investment decision in light of recent commodity price volatility.”2

Now there is some truth in this. Say you agree today to build a Solar Farm that will take 3 years to build, and in the meantime inflation shoots up like it did in the aftermath of COVID and the war in Ukraine. Now your solar panels could be twice as expensive so you can no longer make money at the original strike price.

But now lets go back to the previous piece on solar. If you recall, there are two main costs in setting up your panels, the upfront cost and the maintenance cost of £600 in year 12. Once you’ve built the solar farm, your actual outgoings are equal to the cost of that maintenance . So once you’ve built the solar farm the actual outgoings are low, but you’ve got inflation linking on every unit of energy you produce for the next 15 years, meaning that your profit margins INCREASE as the contract goes on!! The in built assumption then is that the firm makes no money for the next 15 years if you are going to link ALL OUTPUT TO INFLATION!!!

This isn’t the easiest thing to get your head around so I’ll run some numbers to hammer home the point.

Scenario Examples

Let’s say the Bank of England is successful in keeping inflation (CPI) at 2% on average for the next 15 years2. Below shows what happens to the Strike Price by year 15:

Compare this to UK electricity prices historically:

Wholesale Gas prices:

And finally UK CPI:

That’s a 34% increase on average. What’s clear now is you have co-dependence to inflation of your energy prices, but that happens regardless of what happens to wholesale gas prices. If gas prices drop, which sets the marginal price of electricity, the renewable producer will still be paid the difference by the government. You therefore can NEVER HAVE DECREASING ENERGY PRICES!! Look at the period before the war in Ukraine, the UK had stable electricity prices as gas was stable. It didn’t just go up every year!!!

It gets worse…

The energy price cap includes the below in the image. Firstly, any CFD levy (i.e the difference between 1) and 2) above) comes under Government Social and Environmental schemes, so gets added into there and is inflation linked. Secondly, you pay Supplier business costs, which obviously will be CPI weighted,

You have a double counting of inflation, but also a procyclicality too where back dated CPI affects forward looking price caps and wholesale energy costs. This is utter madness given Gas as a resource is generally bounded in terms of what it will cost, even if you are vulnerable to spikes like that seen in the middle of the Ukraine crisis.

It gets even worse…

Just because a generator has a contract doesn’t mean they have to activate it. We have had 5 Allocation rounds so far and the Initial Contract Stage. Let’s see who’s been receiving and paying money so far:

£9.6 billion has been paid out to generators so far, all in the older auctions. Indeed a big problem with AR2 onwards is that generators sell into the wholesale market at a higher price then their strike price and don’t activate the contract. The only penalty if you don’t activate is that you lose the ability to bid for the next auction. So funnily enough, the older contracts with 10 years plus of inflation compounding all activate their contract and sell to the grid at £169 per MwH (UK average last year was £74.81) and the newer ones sell wholesale rather than at their strike price, raising the average.

Of the old contracts this is the current cost to the taxpayer:

The Grande Finale

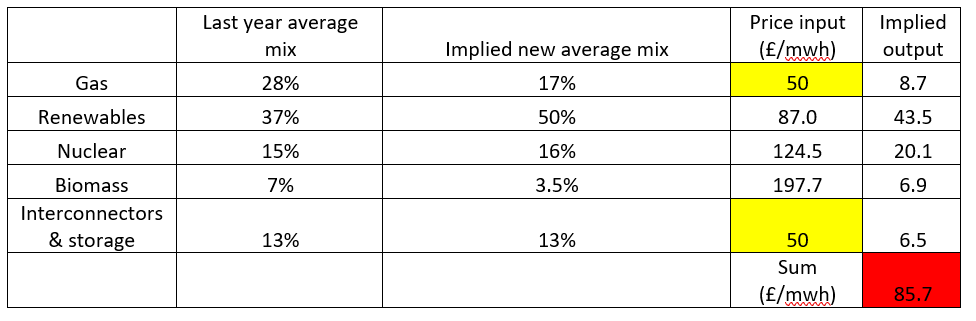

Now let’s model where energy prices will be in 15 years time. I take industry assumptions on energy demand, renewables mix percentage and add in Hinkley (there will be more on this in a future piece). So now I model 3 scenarios for where gas might be. Status quo, higher and the trump drill drill drill gas lower scenario3

Gas is £78 per MwH

Gas is £100 per MwH

Gas is £50 per MwH

That is a range of between a 16% and 36% increase in energy costs over the period. This is before you get into Qanto risks (to come in future piece) from forecasting errors with renewables. But remember this as the key point:

If our competitors overseas continue to use fossil fuels and if that price moves even just sideways over the next 15 years, that would be a 27% increase in our costs relative to them and would put us at a serious competitive disadvantage. It also pours some cold water on the idea that the UK can be a tech hub, why would they bother coming to us with higher baked in electricity costs?

What do we need to do?

I think this is one of the great untold scandals of our time and something that both the previous Government and incumbent have an awful lot to answer for.

Rather than inflation link ALL OUTPUT, you should apportion maintenance/running costs as a beta to overall output and apply a CPI beta to this and apportion installation costs within a window for them to actually build the project.

The current system is absolute madness. Someone needs to be held accountable for designing a system that ensures the UK is it at a competitive disadvantage to other counties around the world, whilst making your life worse at a household level. We need to rip up these contracts and ensure no more taxpayer money is wasted on such a system.

www.marginalcostofeverything.co.uk is now live and is the main portal for MCOE Consultancy services. If you or your firm are looking for advice on how to optimise your energy mix, ensure energy security for your firm, or looking for policy advice at a higher level. Please reach out.

It’s actually the National Grid ESO that administrates here but it all ultimately flows into the LCCC which is a government arm so i’m trying to simplify as much as possible and not get everyone bogged down in acronyms and jargon)

This is in itself is up for debate as many forecasters think we are locked into a higher inflation regime for the next 10 years as a result of the de-globalisation of the world economy

There’s actually more to this, analysis points to a LNG glut in the future which could drop the price of gas even without Trump’s intervention

It's a good question. The answer is multi faceted. Wholesale costs are part of the story, then are the cfd contracts, any levy paid out comes under "policy costs". Next comes forecasting errors, if you misread the amount of wind or sun in 24 hours time or its colder than expected, you need to buy more energy last minute, these get added on to. Then add in gas storage. I've a later piece coming out on this, but our lack of storage and strategic reserve means when we need to buy we buy at the highest price. Very different to the us as a proxy. The price cap guarantee is still being paid off in bills too. There's a few more reasons but that's a flavour. It's not just one thing it's a multitude that add up to higher energy bills. Watch this space, hopefully ill be able to show you everything that makes up your energy bill so we can all hopefully see the ways to make it better.

CfDs are bad enough but the ROC supported generators are at even worse level of largesse then there is all the other costs that come from running an intermittent power system that still has to abide by the mantra of "keeping the lights on"

I suspect you have tackled this in later blogs but only came across your excellent blog from wading through twitter comments on the AR7 announcement so apologies in advance.