Solar’s Odyssey- Part 2 - The Case for Business and the Economy as a whole

A dive into the pros and cons of large scale deployment of solar

www.marginalcostofeverything.co.uk is now live and is the main portal for MCOE Consultancy services. If you or your firm are looking for advice on how to optimise your energy mix, ensure energy security for your firm, or looking for policy advice at a higher level that is devoid of the absolutism of rhetoric and rooted in pragmatism. Please reach out.

For those of you that haven’t read Part 1 of Solar’s Odyssey, it’s worth checking back if you want a detailed description of the household investigation into solar. The case was solid until you start to ramp up the numbers and compete directly with large scale solar generators.

In the Odyssey, Odysseus glimpses Ithaca but then is cast back to where he started, as Poseidon helps lay a trap for his crew that results in them opening a bag of wind that blows them away from their destination. So with that image in our minds let’s start again as we try to find a home for solar.

So where were we?

The key assumption previously was that you could sell back to the grid at 15p per kwh. However as per the below table, Government CFD contracts are set at 6.5p per kwh (for more info on these contracts see the last piece). If there is wide scale adoption you would expect the price they offer to drop significantly, at which point the economics start to break down.

To solidify the point the below table summarises how much energy full household adoption would add to the grid:

If you satisfy 20% of the full energy demand, clearly you won’t be getting 15p per kwh. That would be equivalent to setting the CFD strike for solar at 15p per kwh and increasing the cost of solar energy by 2.3 times.

Back to the drawing board

One of the main drawbacks with domestic solar is that on average, households export 60% of what they produce. Now who might be able to use the energy they produce during daytime hours and potentially the bulk of their energy requirement in daytime hours? Businesses of course. Ok so lets start to tweak the numbers. I’ll start by just applying it to the household model we had before and then applying the numbers specifically by business size.

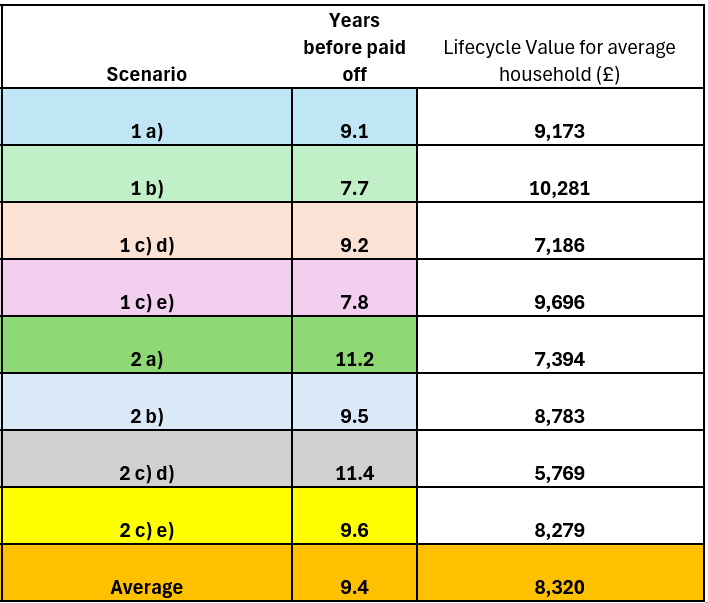

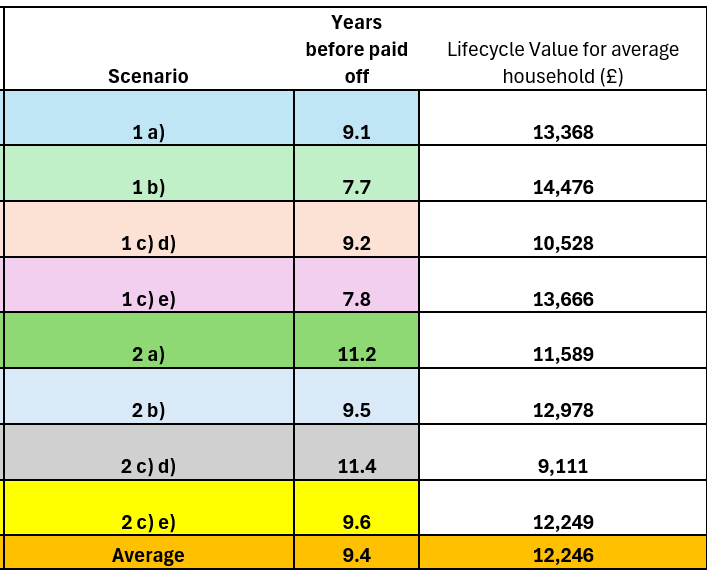

Let’s start by assuming you use 70% of what you produce, i.e. a business that has 9 till 5 operations Monday through Friday. Going back to the original model:

It pays for itself after 10.7 years rather than 12.4 years. It also is worth 2k more to you after 20 years. Now lets run it for a business that is open 7 days a week and can use 100%:

Only 9.4 years to pay for itself and now worth an extra 4k over its lifetime vs the baseline. Now we truly are cooking. Next lets relax the assumption of 20y and say you run them to the topside of their life expectancy (25 years):

That last 5y years is worth an extra 4k to you. The last assumption to tweak is the cost of the panel. Clearly a business has a higher energy requirement and so requires more panels. So let’s apply some economics of scale. E.ON estimates the cost of a 50MW solar farm to be £50m, that’s £350 per Solar Panel. Plugging that in you get:

It now pays for itself within 6y and is worth almost 11k to you. This is obviously a top side estimate but are designed to make a broader point. Small scale household numbers only add if you can export at a decent price. The case for business is far more compelling. In large scale retail environments solar pays for itself very quickly, with useful economies of scale. This should be the big takeaway. Why bother paying the commercial generators when you can save yourself a bunch by installing your own.

Actual business numbers

The numbers above all assume a household level of electricity consumption, for businesses the optimistic scenarios are as follows:

1. Micro businesses use 10,000kwh per year- £62k profit

2. Small businesses use 20,000kwh per year-£125k profit

3. Medium businesses use 37,500 kwh per year-£234k profit

Assuming the Government issues grants to cover the install costs of 15k, 30k and 56k respectively that is an 18.5% return on your investment at a government level over the lifetime. Furthermore you drastically reduce the average demand for electricity if companies are self sufficient.

Take the government grants out of the equation. At a business level this makes sense to do. Taking out loans to pay for this with favourable rates, or indemnity at a government level, we really are cooking and with not anywhere near the amount of outlay.1

In my last piece I wrote about the inflation linking of CFD contracts (Running Up That Hill (A Deal With The Devil?). If you recall I said in 15y this is what the CFD strike looks like (£88 per mwh):

Clearly over time the trade off gets better so over time, even if you have to export some back, the numbers get better every single year as the base of the market moves higher in price.

Business adoption is by far the best way of encouraging widescale adoption of solar. Furthermore it doesn’t result in our homes looking like a Casio calculator.

One last note. Solar is still a young industry (vs heat pumps at least). Innovation is rife. Perovskites are the new big thing. Still in the lab stage, but they promise even lower cost of solar panels for similar efficiency. Half the cost of solar panels? Well ok maybe I’m getting too excited but there is clear route for growth here in a way that just isn’t possible for a mature industry like the heat pump industry.

Okay so what’s the catch?

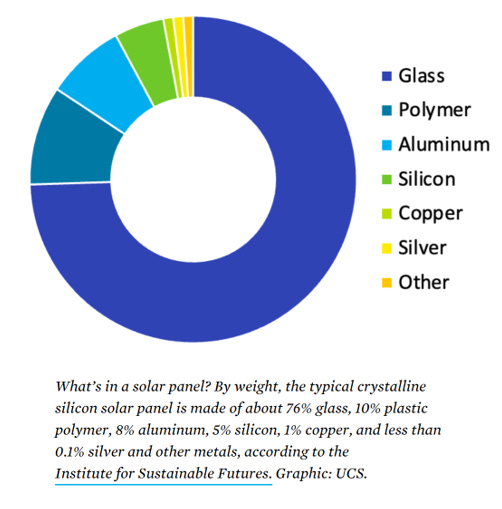

Well firstly what happens to your solar panels after use? Clearly if it all goes to landfill it’s hardly bolstering our green credentials. This is what a solar panel is made of:

Not many nasties when you compare to a lithium battery. As per an article in Greenmatch, between 80% and 95% can be recycled currently. Furthermore:

“Some countries have implemented design laws to ensure the recycling of PV panels, which will take effect in July 2025. Other countries are also focusing on addressing the management of PV waste.”

In sum, Solar recycling is only a young industry in the UK, clearly it will have to grow and develop for large scale usage to work. The good news is that with 85% recycling of silicon already, it looks like this is very possible and with time the processes will benefit from economies of scale that should keep the overall cost low. This therefore shouldn’t be seen as a major issue in locking in high scale adoption of solar panels.

What happens when the sun doesn’t shine?

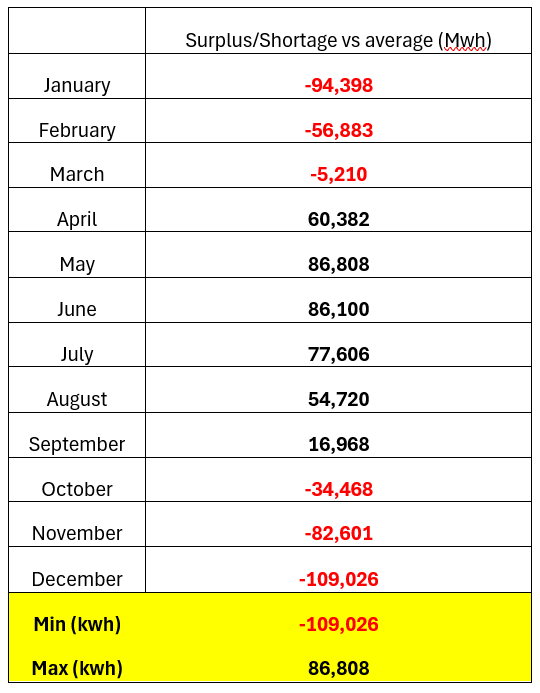

This is by far the biggest issue. Sunlight is not constant and as you set off on your morning commute in the dark this month, clearly varies over the year. This is what the grossed up household model looks like by month taking standard variability in peak sunlight hours:

What this means is in December you need to find an extra 15% of energy and in June work out what you do with the 12% surplus.

These are your 3 options:

a) Dial Down other types of producing energy in times of surplus-BEST solution, build up gas reserves in this time to use in winter?

b) Create Green Hydrogen to burn in the winter- Question is what price you pay? See future article on Hydrogen.

c) Pumped Storage-Ed Miliband has talked of new projects and battery storage. The issue is the cost of doing so and the scalability. How much of the peak district can we give up to this?

The options are listed as a bit of teaser to future pieces. In particular, the notion of dialling down Nuclear is a bit far fetched, short of pulling out the rods and risking a Chernobyl event every time its barbeque season. However, dialling down gas and building up strategic reserves of gas I do think should be a core part of any strategy going forwards. Yes it isn’t pure green, but honestly if you switched every out of town retail centre and industrial park to run on solar but had to turn the gas taps on for 3 months a year, surely that is a drastic improvement on our current situation.

As a final teaser to future pieces. This is a quantile analysis of the impact of seasonality on the wholesale price of energy:

This shows that in the winter the price of energy shoots much higher than what may expected in a linear relationship. The winter months are by far the most crucial part of the year to nail down if we are to bring down the average cost of electricity. Over the next few pieces I hope to show you what the issues are and present some solutions.

Stick around, this is worth watching.

www.marginalcostofeverything.co.uk is now live and is the main portal for MCOE Consultancy services. If you or your firm are looking for advice on how to optimise your energy mix, ensure energy security for your firm, or looking for policy advice at a higher level that is devoid of the absolutism of rhetoric and rooted in pragmatism. Please reach out.

I have not modelled corporate delinquencies and what the actual cost to government is, but clearly the number is not anywhere close to 100% so in this scenario the government gets the same result for less upfront payment, only having to backstop the banks for the difference between the “risk free” rate i.e. gilts and where corporate bonds are, “the corporate spread”

You have taken us by the hand and shown us the reality behind the government spin reflecting Ed Miliband's religious zeal. Are our politicians and large businesses in possession of these facts? If not, what on earth are they basing their policy on, and which interested energy entities have been pushing "solutions" to government that profit only them and cost the rest of us a whole load of money over a protracted period of time?